carried interest tax uk

Unleashing the value of data in a fragmented world. We responded to the review and produced a summary document on carried interest which.

Basic Principles Of Investment Investing Lost Money Wealth Creation

The Carried Interest tax regimes replace any CGT charge which would have already arisen under pre-existing rules but does not replace any pre-existing income tax charge.

. Avoidance of double taxation 1 This section applies where a capital gains tax is charged on an individual by virtue of section 103KA in respect of any carried. Although it is true that carried interest gains are taxed at 28 this is a special higher rate than would be paid on other gains on share sales taxed at a maximum of 20. HMRC Enquiries into the Tax Treatment of Carried Interest.

This can be as much as 20 at a. However the rate of CGT applicable to carried interest remains at 28 whereas a rate of 20 applies to most other types of capital gain. PAYE and NICs indemnity.

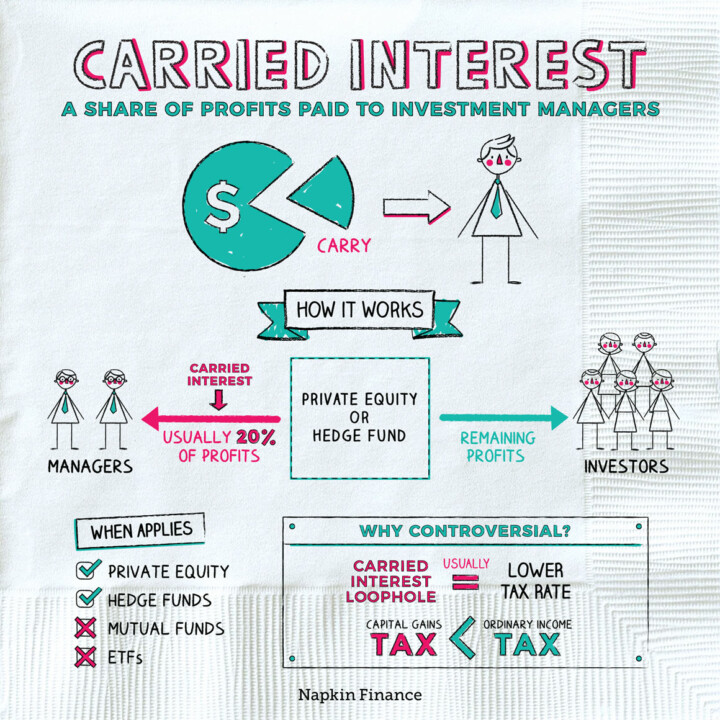

Our previous blog article on the new rules for the taxation of carried interest looked at their general impact on investment managers including the introduction of the concept of. However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net. Instead they charge their investors a management fee of 2 and keep 20 of future profits that their investments generate which is known as carried interest.

This applies to fund managers who provide services in order to share in the funds profits also known as a carried interest or incentive allocation. The carried interest rules impose a minimum 28 per cent tax on carried interest distributions to UK resident fund managers subject to potential reduction for those who are non-domiciliaries. Printable version Send by email PDF version.

Carried interest on investments held longer than three years is subject to a long-term capital gains tax with a top rate of 20 compared with the 37 top rate on ordinary income. 8 Capital gains tax analysis. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

The top rate applicable to. This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain. Carried interest has increasingly come within HM Revenue Customs focus due to the potential risk of ordinary management fees being disguised as carried interest to avoid.

7 rows Under the IBCI Rules carried interest which is income-based carried interest will be taxed. Income Based Carried Interest IBCI which is subject to income tax and NIC and carried interest which is not IBCI. Carried interest now falls into one of two categories.

Availability of business asset. Withholding employee Class 1 NICs. Carried interest as a notional payment.

In July 2020 the Office of Tax Simplification published a review of capital gains tax. Under the current system any carried interest earned by a private equity firm from an asset held more than 40 months is taxed as capital gains. We are aware of an increase in the number of.

And that planning tools. Additionally in April 2016 the UK government introduced legislation the income-based carried interest rules to restrict the capital gains tax treatment of carried interest and. Some view this tax preference as an.

The digital economy dilemma. Private equity executives receiving carried interest could be in for a significant tax hike after the UK announced an investigation into the countrys capital gains tax system.

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Taxes On Money Transferred From Overseas In The Uk Dns Accountants Money Transfer Paying Taxes Blog Taxes

Private Equity The Taxation Of Fund Managers Saffery Champness

Pin By Dissident Fairy On Inspirations Yacht Yacht Boat Yacht Builders

Learn The Tips For Reducing Inheritance Tax Liabilities At Http Www Harleystreetaccountants Co Uk Top Five Tips For Reducing Inheritance Tax Liabilities

Carried Interest In Venture Capital Angellist Venture

In 2011 Convey Sponsored A Tax And Regulatory Survey Carried Out By The Institute Of Financial Operations During A Time Of U Tax Infographic Accounts Payable

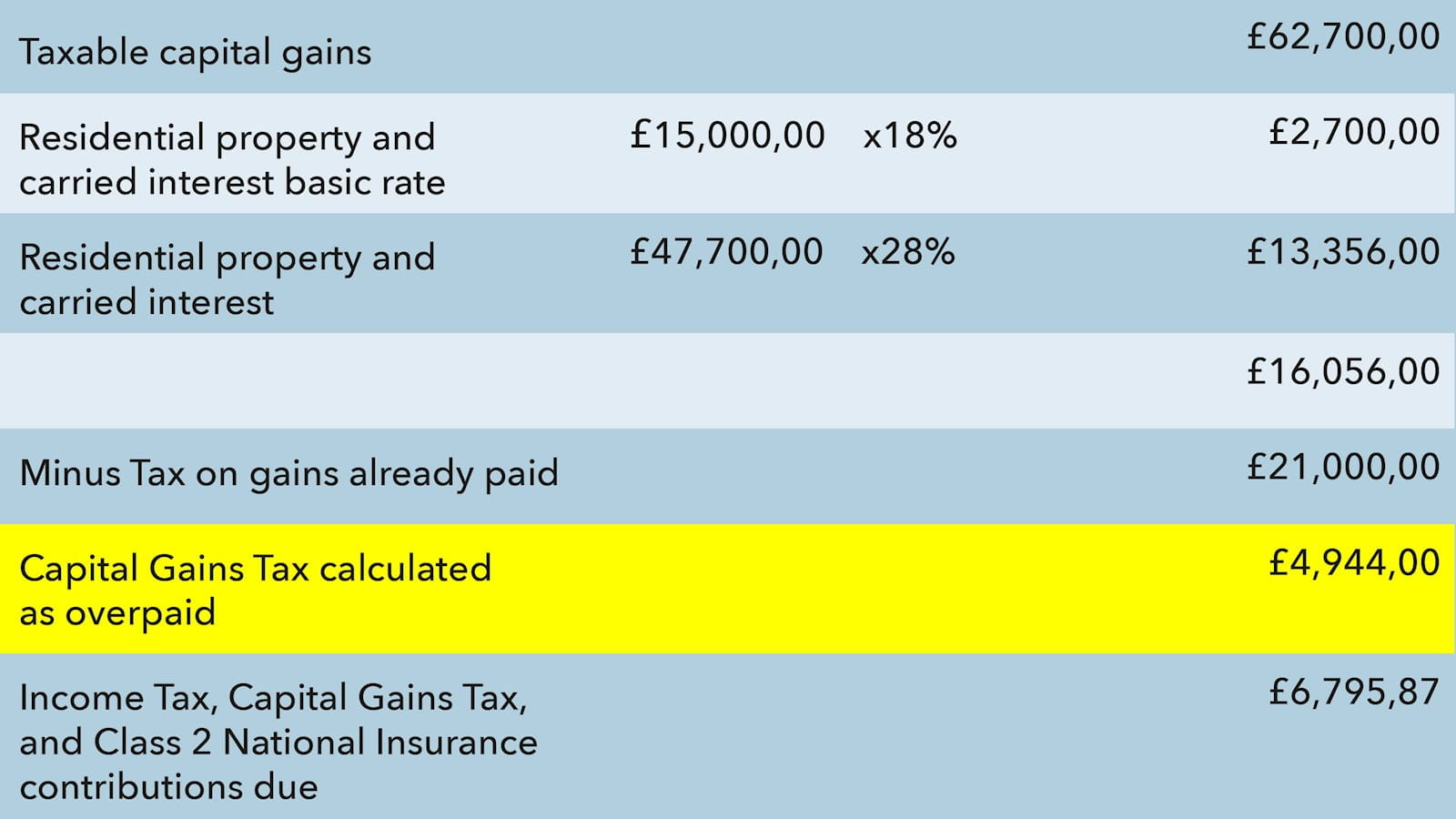

Offsetting Overpaid Cgt Against Income Tax Icaew

Singaporeans Still Top Investor For Uk Property Http Overseascondo Sg Properties Royal Wharf London London Buying Property Black Brick

How Does Carried Interest Work Napkin Finance

Carried Interest In Private Equity Calculations Top Examples Accounting

Why Slowly Nudging Up Interest Rates Makes Sense Investment Property Mortgage Rates Investing

Financial Planning Services Irving How To Plan Wellness Design Financial

How To Tax Capital Without Hurting Investment The Economist

How Can We Afford The Freedom Dividend Dividend The Freedom Financial

Definitive Guide To Carried Interest Book Private Equity International

This Infographic Shows Just How Much Corporation Tax Amazon Starbucks And Google Have Avoided Paying And How That Money Could Be U Infographic Corporate Tax

Taking Goods Temporarily Out Of The Uk How To Apply Understanding United Kingdom